Regulatory Strategy, Securities Compliance, and Risk Management

My Services:

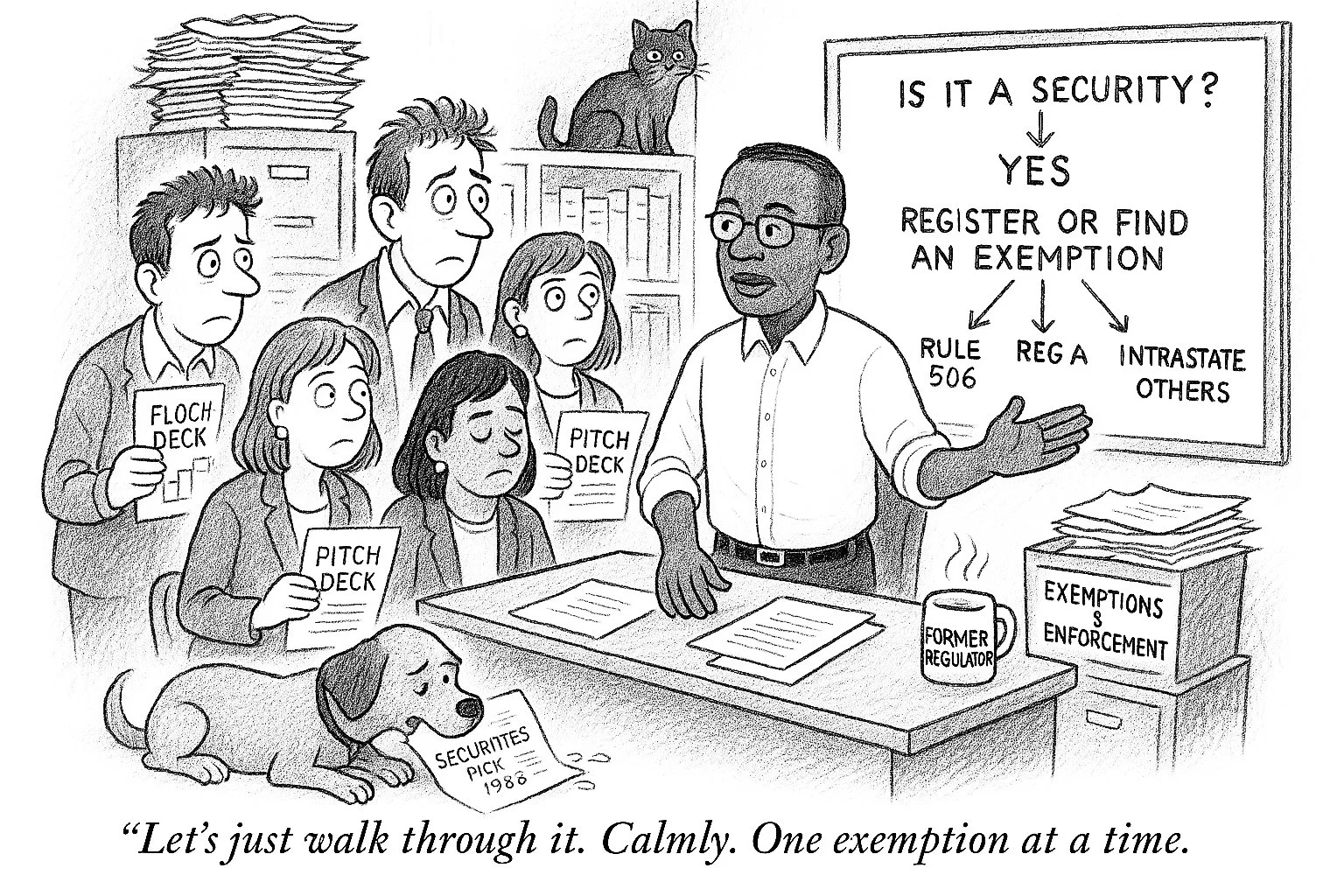

The Law Office of Jason E. Ambers provides end-to-end legal guidance for companies conducting securities offerings — whether public or private, exempt or registered. LOJA’s services include:

Analyzing a proposed transaction.

Determining whether the transaction involves the sale of a “security.”

Determining whether the offering has to be registered, and, if necessary, identifying possible exemptions. (e.g. Rule 506, Regulation A, Regulation Crowdfunding.)

Determining the state blue sky registration or filing requirements.

Preparing and submitting multi-sate blue sky filings.

Managing regulatory communications and coordinating responses to comments from regulators.

Preparing a “blue sky memorandum” describing the scope of permissible activity in each state.

Managing post-filing compliance (amendments, renewals, terminations, etc.).

While I do not serve as an issuer’s primary SEC counsel, I do work effectively and collaboratively alongside an issuer’s SEC counsel on blue sky securities offering compliance, regulatory strategy, and risk management —especially on complex matters where strategic coordination is critical.

The Securities Registration Requirements:

The federal and state securities laws generally require that a security be registered before the security is offered or sold. The securities laws also exempt certain securities (or securities transactions) from the securities registration requirements. In some cases, a person must make a filing and pay a fee to rely on the exemption. Persons selling the securities must also be licensed, unless they are exempt from the licensing requirements.

Because of the interaction between the state and federal securities laws, it is sometimes the case that 1) an offering must be registered under both state and federal law before the security is offered or sold, 2) an offering that is exempt from state registration must be registered under the federal securities law, 3) an offering that is exempt from federal registration must be registered in the state (or states) where the security is being offered and sold, or 4) an offering does not have to be registered under either federal or state law.

Issuers of securities that are exempt under SEC Rule 504, Rule 506, Rule 701, Regulation A, and Regulation Crowdfunding as well issuers of securities of non-traded real estate investment trusts, non-traded business development companies, non-traded private credit funds, and non-profit organizations should pay particularly close attention to the securities registration and filing requirements in each state in which their security is offered or sold.

My Value:

As the lead securities registration attorney at the Oregon Department of Consumer and Business Services, I reviewed most of the securities that were registered in Oregon. Those offerings ranged from a small offering in a grocery cooperative to bond offerings by religious and non-profit organizations to large and complex offerings by real estate investment trusts, private credit funds, and business development companies. I bring not only deep expertise in state securities registration requirements and exemptions, but also an insider’s understanding of the regulatory review process and the practical challenges issuers face in navigating it.

What sets me apart is that I understand these challenges from multiple vantage points. Prior to public service, I worked as both an investment banker and a corporate lawyer, advising on securities offerings from the inside. That experience informs my approach today—I know how offering documents are structured, how capital formation strategies evolve under market pressure, and how regulatory decisions can impact timing and execution.

Clients especially value my ability to engage productively with regulators and stakeholders—a skill developed through years of working closely with colleagues, issuers, attorneys, and market participants. During my tenure as Oregon’s senior securities registration attorney, I regularly issued comment letters, provided both formal and informal guidance on capital raising strategies, and advised on compliance obligations and how to avoid (or mitigate) potential violations.